According to Rethink Technology Research's Rethink TV service, live streaming video, enabled by new and emerging low latency protocols, is growing rapidly on content delivery networks (CDNs).

Video makes up an increasing proportion of CDN traffic, and CDNs in turn are expanding their share of all IP traffic. But the main emerging factors are expected to be a surge in live streaming video traffic, and hitched to that a boom in low latency protocols, particularly the SRT (Secure Reliable Transport) and possibly Reliable Internet Stream Transport (RIST) protocols because of their ability to shave latencies much closer to the ultimate limits imposed by the laws of physics.

Though the rise of subscription video on demand (SVOD) was fast, the rise of "live" content is expected to happen even faster and create more changes in both the entertainment landscape and its underlying technology backdrop. SRT has emerged as the protocol of choice for delivering live video as close to "synchronous" as possible.

Live streaming has only just emerged from the shadow of SVOD, which has dominated streaming traffic ever since Netflix began ramping a decade ago. Even though SVOD has plenty of room for growth yet, live streaming traffic is expected to rise much more steeply and overtake non-live video traffic between 2023 and 2024. Live video accounted for 11 exabytes (EB) compared with total CDN video traffic of 58 EB in 2018; by 2024 it is expected to be 238 EB against 453 EB.

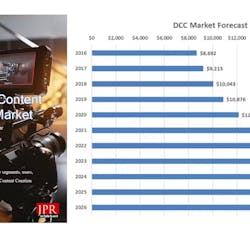

Some SRT traffic is expected to go through CDNs and some over unmanaged Internet traffic as part of online video platforms. Comparing revenues associated with SRT traffic against total video CDN traffic, the research house expects SRT revenue to rise from 2% in 2018 to 43.5% by 2024. While 2018 SRT traffic generated $236 million compared with $4.46 billion for CDNs in total, by 2024 it is expected to be $9.66 billion out of $22.2 billion.

There are also strong regional differences in rates of growth in CDN video traffic and particularly live streaming, with Asia Pacific set for an especially rapid increase in traffic, which is expected to account for 51% of the world's total in 2024 compared with 29% in 2018. There are also considerable regional differences in the proportion of total CDN video traffic accounted for by private CDNs owned by larger streaming providers such as Amazon and Netflix. Those are expected to account for a rising proportion of total CDN traffic in all regions, but with the trend strongest in North America where they are expected to take 75% by 2024.