According to Frost & Sullivan, with telecommunication service providers and cable multiple system operators (MSOs) continuing their fiber buildouts, the market for fiber optic test equipment (FOTE) is expected to grow from $781.3 million in 2018 to $1.31 billion in 2025. The lack of fiber expertise among access network technicians and the sheer volume of fiber deployments required in a short time are expected to enable innovative fiber test gear manufacturers to differentiate themselves in the market.

"A significant development that is impacting demand for optical test equipment is the evolution of 5G and its fixed wireless access (FWA) trials. 5G is expected to support the wide-scale implementation of fiber and boost the demand for test equipment," said Sujan Sami, program manager, Measurement & Instrumentation, at Frost & Sullivan. "Telcos and cable MSOs will be the biggest growth drivers for FOTE manufacturers, generating $4 billion in revenue between 2018 and 2025."

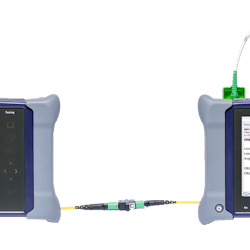

Frost & Sullivan's recent analysis, "Global Fiber Optic Test Equipment Market, Forecast to 2025," covers the product segments of optical time domain reflectometers (OTDRs), optical light sources(OLSs), optical power meters (OPMs), optical loss test sets (OLTSs), optical spectrum analyzers (OSAs), remote fiber test systems (RFTSs), fiber inspection probes (FIPs), and others. The products find application in the sectors of R&D, manufacturing, and field across North America, Europe, Asia-Pacific, and emerging regions.

"While North America is the largest regional market for FOTE, demand is also growing substantially in Europe and emerging regions such as Latin America," said Sami. "Meanwhile, FOTE vendors are looking to strengthen existing relationships with leading telcos and cable MSOs in North America, as well as target hyperscale companies and government customers."

Successful FOTE vendors are expected to be the ones that tap the additional growth opportunities present in:

- Collaborations with tier I and tier II service providers to innovate and, eventually, address challenges relating to the lack of fiber expertise among technicians and workforce management.

- Provision of smarter and customized OTDR solutions to address customer needs for increased productivity and user safety.

- Development of a strong network of partners, combined with strategically located direct presence in Latin America.

- Fostering relationships with governments and contractors to leverage the opportunities offered by government cybersecurity projects.