The top cable MSOs combined lost approximately 60,000 broadband subscribers in the second quarter of this year, according to Leichtman Research Group, Inc. (LRG). The combined loss is the first recorded for cable operators as a group. Pay TV subscriptions also foundered during the quarter.

Overall broadband numbers were positive, thanks to an 815,000 subscriber jump from fixed wireless/5G providers T-Mobile and Verizon. That figure offset the poor cable MSO numbers as well as an overall 85,000 decline from wireline telco companies. The telco decline derived from a 575,000 shrinkage in DSL subscribers, which proved too much for the 490,000 net adds via fiber to overcome.

Put it all together and the broadband industry saw about 670,000 net additional broadband internet subscribers in 2Q22. That figure pales to the 1 million subscribers gained during the year-ago quarter.

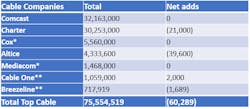

A table LRG provided of the top cable providers’ performance in 2Q22 painted a disturbing picture:

Does pay-TV still pay?

Meanwhile, pay-TV subscribers took a similar tumble. LRG reports that the top U.S. companies in this space, who collectively compose about 92% of the market, lost approximately 1,925,000 net video subscribers in 2Q 2022. This number is greater than the pro forma net loss of 1,235,000 in 2Q21.

The top cable providers suffered a combined net loss of about 950,000 video subscribers in the quarter, greater than the approximately 590,000 subscribers lost in 2Q 2021.

“The second quarter of 2022 marked the second consecutive quarter with over 1.9 million net pay-TV losses,” commented Bruce Leichtman, president and principal analyst for LRG. “Over the past year, top pay-TV providers had a net loss of about 5,425,000 subscribers, compared to a net loss of about 4,550,000 over the prior year.”