While the telecom industry is ever-evolving, COVID-19 changed everything over the last 18 months. But what impacts did the pandemic really have? To find out, Alianza hired Independence Research, a broadband industry analysis firm, to gain insight into the state of the cloud communications market among small and medium businesses (SMBs).

In early 2021, Independence Research conducted a survey of over 500 SMB telecom decision makers in the United States at companies employing between 5 and 999 personnel. The respondents, who were professionals with direct control or knowledge of telecommunications spending strategies, were asked about the biggest market trends, their buying plans — including communications and collaboration requirements, priorities, and preferences — and the criteria they used for evaluating service providers and communications platforms. The results were notable.

This feature will review some of the key findings of that research with the goal of helping service providers identify potential customer requirements and market opportunities.

Top-line takeaways

Before we get into the survey result details, let’s look at some of the highlights:

Key takeaways:

- The COVID pandemic has accelerated the adoption of cloud collaboration services.

- SMBs still view voice services as fundamental to doing business.

- SMBs prefer to obtain voice and collaboration services from a single trusted provider.

- Broadband providers are well positioned to win and retain cloud communications customers.

Noteworthy statistics:

- 70% of SMBs increased the use of existing collaboration solutions during the pandemic.

- 41% of SMBs said they introduced new collaboration tools during the pandemic.

- Fewer than half — only 48% — of SMBs believe their existing communications tools are adequate for work-from-home (WFH).

- 49% of SMBs would prefer to add collaboration services to their voice service — as opposed to adding voice to their collaboration solution (34%) or keeping voice and collaboration separate (17%).

- 91% of SMBs consider voice and/or advanced communication services essential to their success.

- 87% of SMBs would prefer to purchase phone and cloud communications from their broadband provider — if the VoIP features met company requirements.

What’s behind these findings? SMBs have been embracing digital transformation and transitioning communications and collaboration services to the cloud for quite some time, but last year’s COVID stay-at-home mandates caused many SMBs to accelerate their plans.

Looking ahead, many of the changes brought on by the pandemic will have lasting implications for service providers, such as the need to support increased numbers of SMBs that continue to rely on work-from-home or hybrid work models. For these SMBs, voice services will continue to play a vital role for both internal conversations and customer interactions. And, with 83% of SMBs preferring a single trusted provider for both voice and collaboration services, a growing number of opportunities exist for enterprising ISPs, MSOs, and telcos.

Let’s take a look at these opportunities.

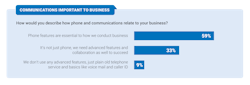

Abundant voice opportunities

Despite the headlines on cord cutting, mobile-only communications, and consumer preferences for texting, voice services are still considered essential for how businesses operate and succeed. While unified communications (UC) solutions are growing in popularity for internal communications, traditional voice is still seen by SMBs as fundamental – especially for customer interactions. This is highlighted by over half of the survey respondents (59%) saying that voice services are essential for their business and almost one-third (33%) indicating that advance voice features are critical for success.

It’s not surprising that the majority of SMBs (59%) get their voice services from a traditional telecom provider or cable broadband operator, as fewer than 20% of SMBs said they use an over-the-top (OTT) provider for voice services. Additionally, nearly 60% of survey respondents said they have switched or seriously considered switching voice providers in the past several years. Given these findings, service providers still have plenty of opportunities to retain existing customers, secure new voice customers, and win back old ones.

So, what are SMBs looking for in their voice provider? Their top criteria for selecting a voice provider are ease-of-use, speed and efficiency of deployment, and brand reputation. Surprisingly, SMBs don’t place as much emphasis on a service provider’s local presence. However, if all other criteria are equal, a local presence can certainly be a differentiator for a provider, given its advantages for setup and support.

Offer a choice in endpoints

Today’s SMB workers have a variety of occupations and use cases that would benefit from being able to access their business communications services from anywhere – at home, in the office, on the road – using any device. The need for service providers to offer a softphone is emphasized by the fact that 63% of survey respondents said their employees require a softphone, and one-quarter of those indicated it’s the only phone their employees need.

However, contrary to popular belief, good old desk phones aren’t going away anytime soon. Of the survey respondents, 74% said their employees require a desk phone, and over one-third said their employees require only a desk phone.

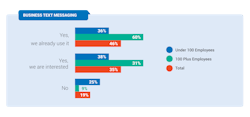

Business text messaging is a powerful communications channel

Business text messaging (BTM) services enable organizations to add new SMS and MMS communications channels using their existing phone numbers. With features like automated keyword responses, scheduled responses, contact management, and marketing campaigns, SMBs can leverage their phone number for multiple types of inbound and outbound communications. Most SMBs surveyed view BTM as a valuable communications channel, with 82% saying they use or are interested in using BTM services.

SMBs view BTM as an avenue for streamlining customer service, improving sales and marketing campaigns, and efficiently responding to prospect inquiries. Service providers can better serve their SMB customers by adding a BTM service as a standalone offering or bundled with their voice and UC services.

Be a single source for voice and collaboration

The vast majority of survey respondents (87%) said they’d prefer to add phone and cloud collaboration services to their existing voice services rather than purchasing each service from different providers. The larger the business, the more likely they were to prefer a single-provider solution.

This presents a sizeable opportunity for CSPs and voice providers who add UC offerings to their portfolios, especially because CSPs have a decisive advantage over OTT players.

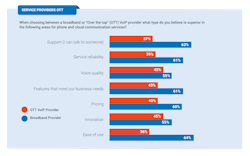

SMBs view service providers as superior

When survey participants were asked to compare broadband providers with OTT VoIP providers on seven different product, company, and support capabilities, the respondents rated broadband providers as superior in all areas.

Respondents gave broadband providers higher ratings for support, voice quality, and service reliability. But most SMB decision makers also believe that broadband providers offer better pricing, innovation, and ease of use, which are key selling points for many OTT VoIP services.

Looking forward

Alianza’s 2021 Cloud Communications Survey revealed substantial opportunities for service providers. Digital transformation trends, accelerated by the global COVID-19 pandemic, have expedited the demand for service providers to offer cloud collaboration services. With voice services continuing to be indispensable to SMBs, and a clear preference for adding collaboration functionality to their existing voice solutions, service providers can gain key market advantages with the cloud.

Based on the survey data, we recommend service providers consider the following actions:

- Pursue cloud-based UC services for SMBs adopting work-from-home and hybrid work models. Fewer than half of SMBs said they are satisfied with their existing collaboration solutions.

- Emphasize the continued importance of voice for business-to-consumer interactions in marketing. 90% of SMBs consider voice services essential.

- Give customers a variety of endpoints to choose from, including desk phones and softphones, and be sure to have a UC application solution that supports both.

- Add business text messaging services to your portfolio to boost revenue and customer stickiness. SMBs overwhelmingly believe BTM can help streamline sales, marketing, and support interactions.

- Show customers the advantages of selecting a trusted service provider that can deliver superior customer support, service quality, and reliability. And leverage a communications platform that gives you innovation and ease of use advantages.

Hanna Miller is Vice President of Marketing at Alianza.