If you’re a U.S. cable operator unhappy with the cord-cutting within your subscriber base, IHS Markit (NASDAQ: INFO) would like you to know that it’s not just you. A new report from the market research firm indicates that 14 markets around the world saw a drop in pay TV subscriptions last year. Of course, the effect was worst in the U.S. – but you may have felt a bit better for a few seconds, right?

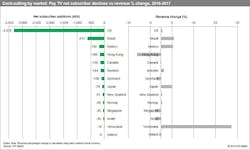

In addition to service providers in the United States, pay TV suppliers in Brazil, Mexico, Hong Kong, Canada, Sweden, Denmark, Japan, New Zealand, Norway, Singapore, Israel, Venezuela and Ireland saw cord cutting and other factors decrease their subscriber numbers in 2017, according to IHS Markit. “The cord-cutting woes of pay TV companies in the U.S. have been well publicized,” said Ted Hall, director of research and analysis for TV and video at IHS Markit. “Although the rest of the world has been broadly resisting the trend, other markets have also experienced pay TV subscription losses.”

Overall, North America suffered its biggest-ever annual pay TV decline in 2017. Latin America experienced its first net decline in pay TV subscriptions since 2002 last year, with cord cutting contributing in part to decreases in Brazil (which lost 617,000 subscribers) and Mexico (down by 192,000).

That said, service providers in 8 of the 14 markets, including the U.S., still managed to avoid overall losses in revenue, as the graph shows. In the U.S., operators were able to increase pay TV revenues thanks to upselling and price increases, says IHS Markit.

“As part of their response to cord cutting, a growing number of pay TV operators are launching their own standalone streaming services to compete directly with offerings from Netflix, Amazon Prime Video and other OTT video companies,” Hall said. “These virtual pay TV alternatives to traditional pay TV are more flexible and typically priced lower than operators’ core offerings. However, substituting pay TV subscriptions for OTT is only a partial solution, as these services have lower average revenue per user and are therefore worth less to operators.”

The situation in North America is only expected to get worse going forward. IHS Markit expects further cord cutting in North America, with a net decline of 8.5 million pay TV subscriptions anticipated between the end of 2017 and the end 2022. Latin America, meanwhile, is expected to return to growth as Brazil continues its economic recovery.

But even where pay TV subscriber numbers rebound, the march of OTT video will continue over the next five years at least, IHS Markit predicts. OTT net additions are expected to surpass those of pay TV through the end of 2022 everywhere except the Middle East and Africa. The market expects total global adds of 409 million for OTT video over the forecast period, with almost two-thirds to come from Asia Pacific.

The findings come from IHS Markit’s newly published report, Global Cord-Cutting Tracker 2017.